Published in Scientific Papers. Series "Management, Economic Engineering in Agriculture and rural development", Vol. 20 ISSUE 4

Written by Daniela SIMTION

Claims related to investments may be a source of tax evasion by granting a loan to a daughter company (in which the parent company holds a majority interest rate) with a higher or lower interest * depending on the need to transfer value between companies, by the limit of expenses allowed by the tax law, as well as other interests, such as the need to cover the interest expenses from the financial and other incomes of the debtor company. Starting from the above, a very large number of value transfer strategies can be conceived between companies belonging to the same holding (a company that holds the majority interest in several companies). This paper refers to the classic case of tax evasion through loans between companies of the same holding company, including those in the agricultural field.

[Read full article] [Citation]

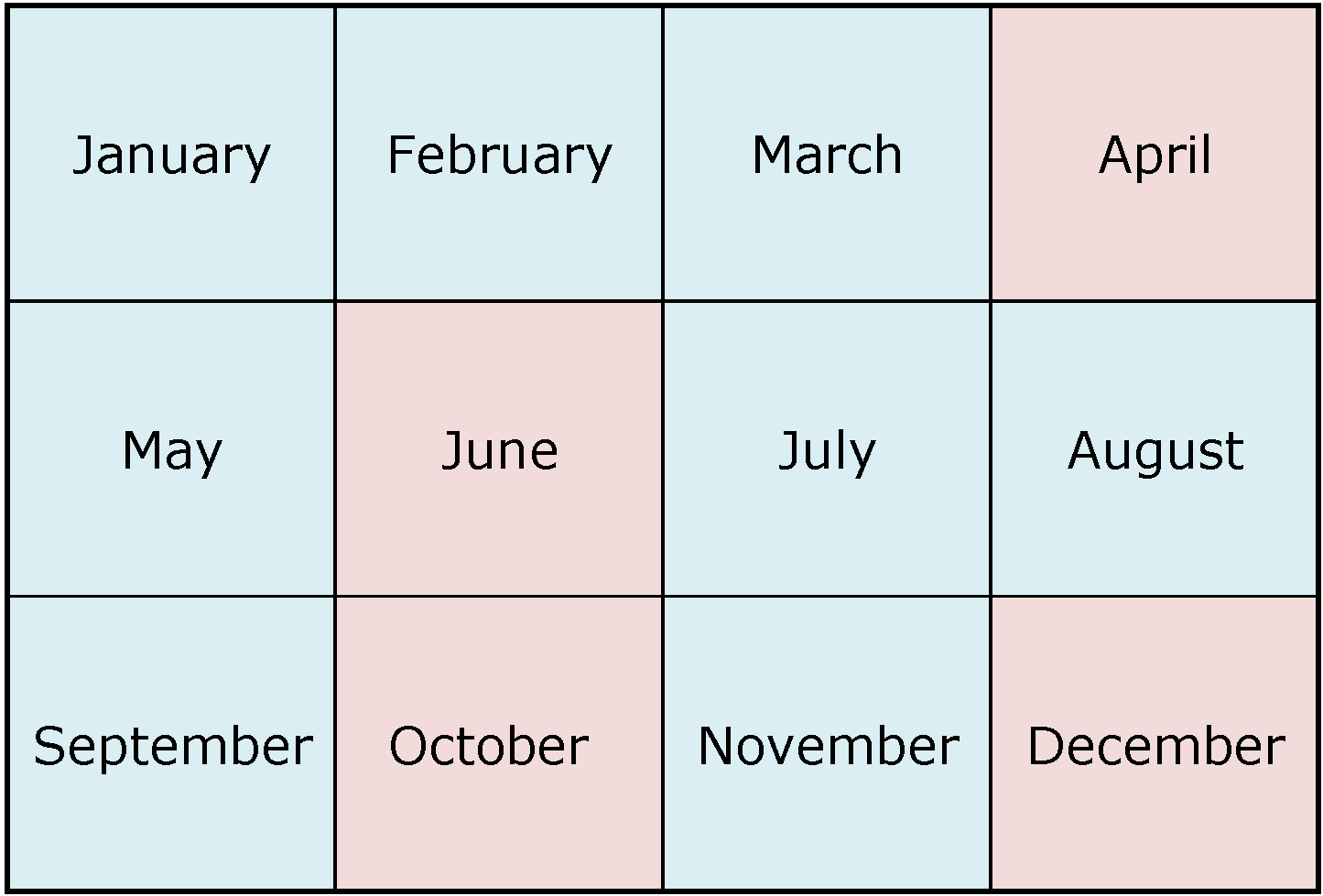

Next Issue will be published according the the calendar.

Next Issue will be published according the the calendar.