Published in Scientific Papers. Series "Management, Economic Engineering in Agriculture and rural development", Vol. 21 ISSUE 3

Written by Chidiebere Innocent MBANASO, Christopher Ogbonna EMEROLE

The paper dealt on empirical trend analysis of interest rate and value of agricultural finance in Nigeria between 1986 and 2017. It was the specific objectives of the study to: describe trends of interest rate and value of formal agricultural funding in Nigeria for the period 1986– 2017; determine the path of progress of interest rate and value of formal agricultural finance in Nigeria for the period under review; compare rate of growth of interest rate and value of formal agricultural funding in Nigeria within the reference period; and analyze trend of interest rate in Nigeria within the reference period; explain the cause and effect relationship of interest rate and value of formal agricultural finance in Nigeria within the reference period. Secondary data was used for the study and these were subjected to descriptive statistics and econometric analysis. However, the trend revealed a persistent increase in the interest rate between 1986 and 1998 coinciding with the Structural Adjustment Policy era. The interest rate then dropped slightly between 2000 and 2006 and then began to trend upwards from 2007 to 2017. These are manifestation of volatility of interest rate to agricultural funding. In overall status, interest rate exhibited negative non-considerable trend while volume of formal agricultural finance exhibited positive trend within period 1986- 2017 in Nigeria. The study therefore recommended that the monetary authorities in Nigeria should maintain a stable interest rate policy to ensure that adequate formal financing flow from banks to the agricultural sector. Commercial banks should concentrate on mobilizing savings by charging lower interest rate and providing handsome return to depositors which would increase funds flow and make it available for formal financing of agriculture.

[Read full article] [Citation]

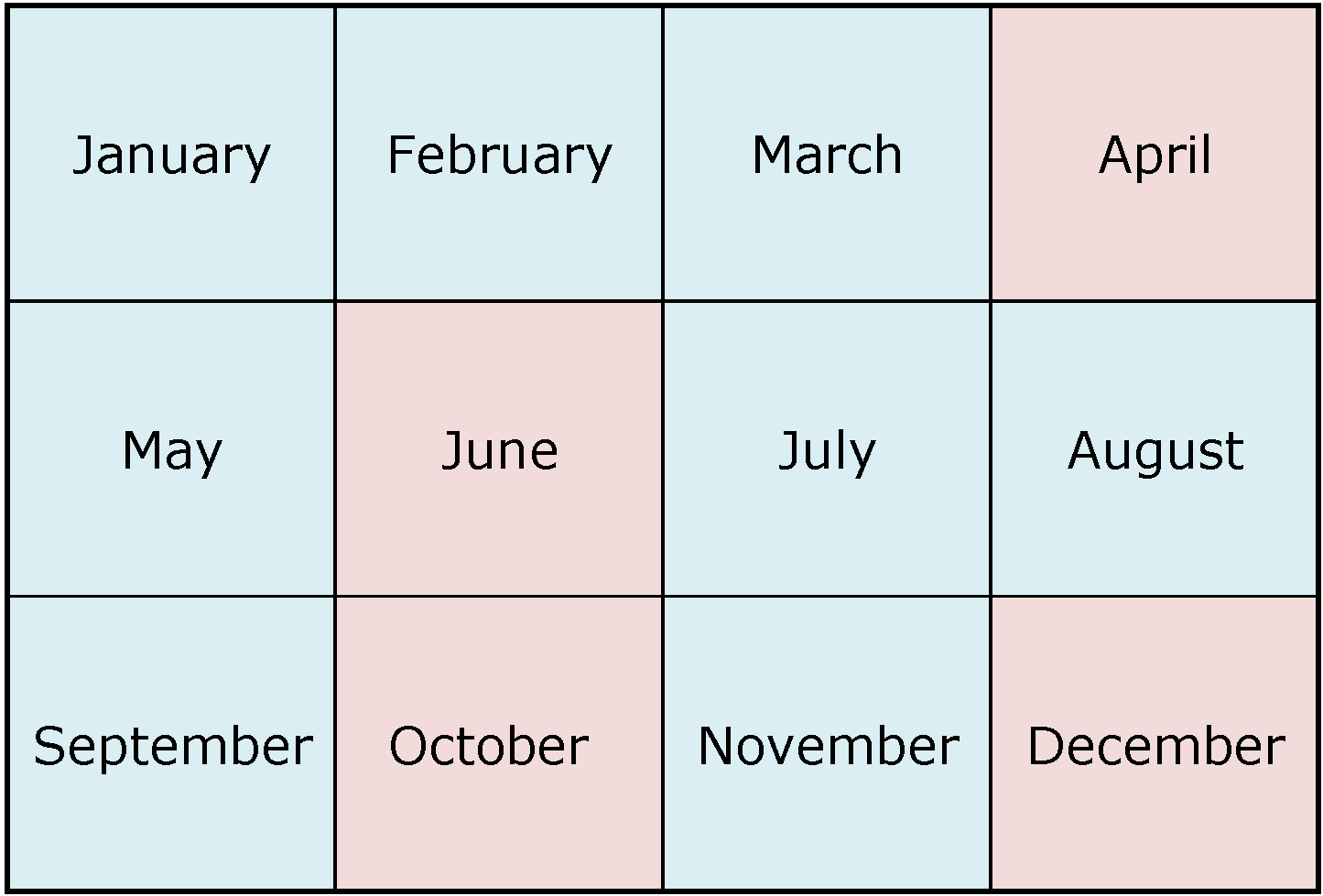

Next Issue will be published according the the calendar.

Next Issue will be published according the the calendar.